Written by

Liven

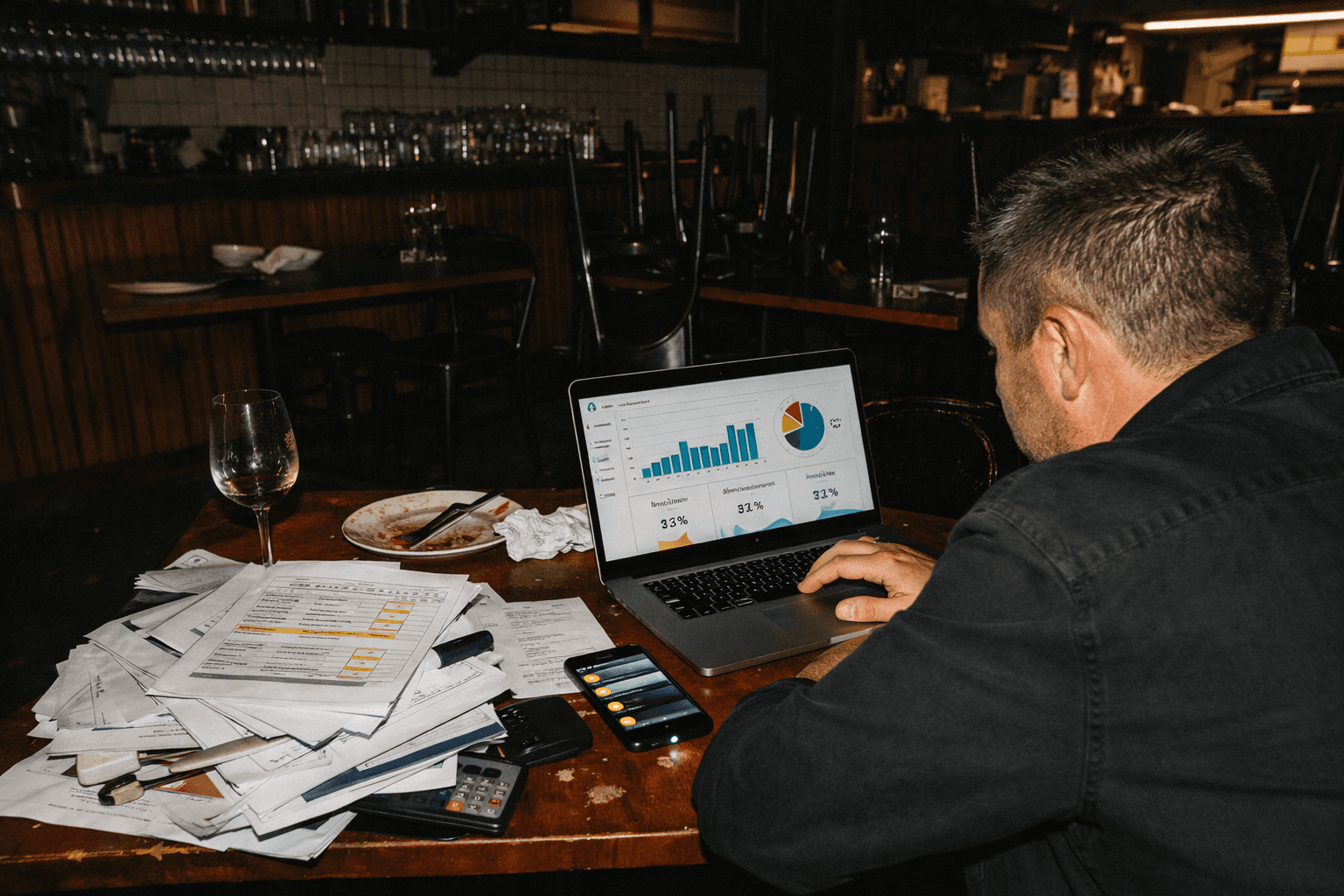

The ultimate hospo solution

The good news is from 1st July the instant asset write-off threshold will sit at $20,000. That means businesses with an annual turnover of $10M or less will be able to deduct the entire cost of assets that cost less than $20,000. The assets must be installed or ready for use between 1st July 2023 & 30th June 2024. Now is the time to purchase new kitchen equipment, coffee machines, iPads and technology tablets under the new scheme for your business!

The $20,000 threshold applies to each individual asset meaning businesses can buy and write off multiple assets so long as each asset costs less than $20,000.

This is a nice surprise for hospitality businesses as last years budget pitched this initiative to end in June this year. It’s again predicted this initiative won’t be renewed for the next financial year, so we suggest you secure those big asset purchases soon. For more information regarding the 2023 - 24 Budget you can visit https://budget.gov.au/

Don't miss out on this opportunity to provide your customers with a first class experience with the latest technology installed in your venue. Creating magic moments that bridge the physical environment with digital touch-points not only improves the diner experience but makes your business more efficient, lowers costs and lets you own and integrate your data, helping to further improve and optimise your business.

Speak to the team at Liven today about how we can help you leverage the latest technology to supercharge your venue and join 5000+ merchants that use Liven to serve, engage and connect with their guests like never before. Click here to get in touch now.